Things you can’t see on a map

There are of course many important details that a map view won’t illuminate. The two main ones are zoning details and title issues.

Zoning Bylaws

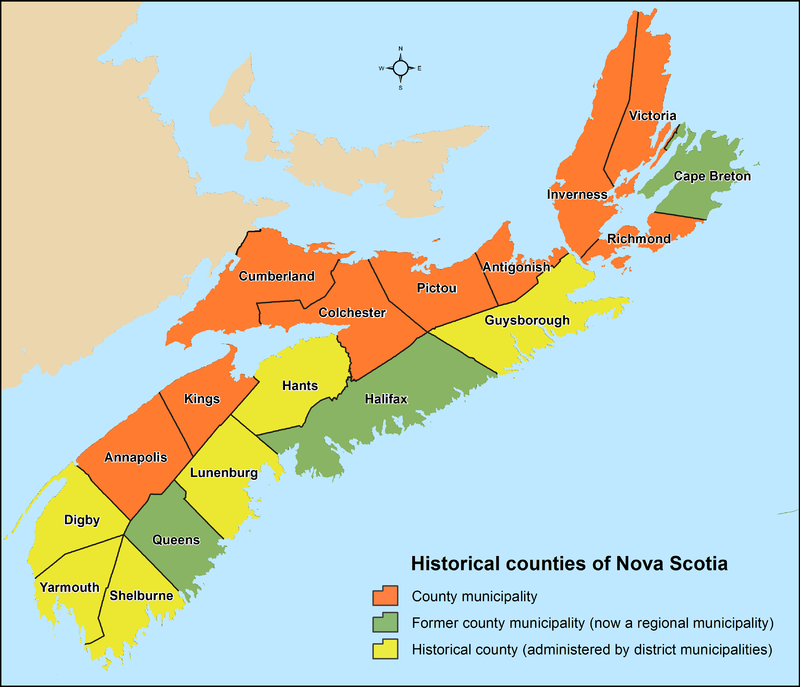

Zoning refers to land use bylaws of the local municipality. These are highly localized to the specific area – no one-size-fits-all answers. If there’s a realtor involved on the buying or selling side, they should be able to inform you of the zoning and the relevant uses. For a private sale, searching within the municipality may yield some luck. UPDATE! Search no further my friend… we’ve compiled links to all Nova Scotia land zoning maps and land use bylaws for every region in Nova Scotia.

Let’s use an example. I have a 14-acre lot near the Cabot Trail that falls under the jurisdiction of the County of Inverness. Through our handy list of all Nova Scotia zoning maps I was able to find the zoning map for Inverness and determine that my lot is zoned as RR-1 – Rural-Residential. From there it’s a matter of digging into the relevant local land use bylaw. These are long documents that contain all the ordinances associated with each type of zone. For RR1, for example, the following land uses are permitted:

- Single detached dwelling

- Duplex and Semi-detached dwellings

- Converted dwelling up to two units

- Mobile homes subject to setback requirements

- Cottages and other seasonal dwellings

- Tourist and guest homes

- Agricultural uses including barns and stables

- Forestry uses

- Post offices

- Community centres

- School, churches, cemeteries and other similar institutional uses

- Recreational uses such as parks and playgrounds, golf courses, beaches and associated buildings and uses

- Campgrounds and associated uses

- Existing Mobile Homes which are located within the 300 foot setback requirement from the Cabot Trail

The document also contains provisions for minimum yard space and maximum height of buildings. Now, this is an example of when you fairly easily find what you’re looking for. In many cases you won’t – you can always get in touch with the municipality if you need a definitive answer. Adhering to Nova Scotia’s zoning bylaws is quite important and it’s a good idea to review these provisions in detail, even if you have a realtor summarizing the information for you. If you have a specific plan in mind for the lot (e.g. building a summer campground) talking directly with the person who approves permits could provide you with some vital information for your go/no-go decision.

Title Issues

Title refers to the legal documents binding the land to a specific owner, as well as details and provisions specific to that land. It includes, among other things:

- The various deeds associated with the property over the years

- A map of the property

- Easements and rights of way (often included in the deeds mentioned above). These are especially important when land appears landlocked (no road in) or if there are shared private laneways or driveways. You’ll also find that many easements exist for logging operations within Nova Scotia.

- Claimholders on the property (e.g. mortgage owner)

Title reviews and issues are often the realm of Nova Scotia real estate lawyers, and I’m not one. Typically a title review is a step undertaken by a lawyer late in the purchase process. It ensures the land is indeed owned as indicated and identifies any potential red flags for the buyer.

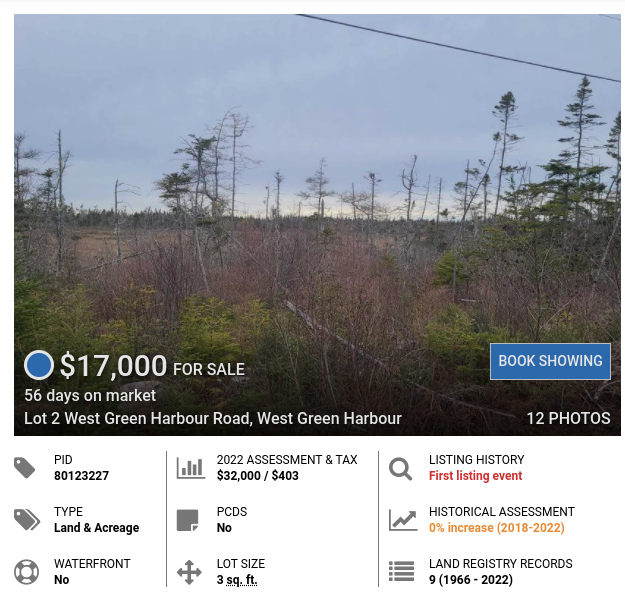

You can, however, gain access to the database that houses all documents related to properties in Nova Scotia. Access Nova Scotia’s Property Online (POL) database is available to subscribers for roughly $100 monthly (as of March 2023). I pay this fee and use this land registry database as an essential component of due diligence as I research properties. For buyers who are considering a private sale of Nova Scotia land, as an early step in their process, I recommend conducting a title search using Property Online’s Land Registry.

Closing the purchase of your land

Much like buying a house, the purchase of land involves the following steps. Usually there’s a series of questions from seller to buyer (directly in a private sale, or through a realtor when one is involved). There are a lot of important things to look into and ask about, which is why we compiled our list of Good (and bad) questions to ask when buying land in Nova Scotia.

Once the potential buyer has all the information they need, the next steps are:

- Negotiation, or the presentation of a written offer

- Signed acceptance of the offer and associated terms

- Deposit delivered by buyer within a specified timeframe

- Title search and deed transferal / registration conducted by the buyer’s real estate lawyer

I’m not going to dive into a lot of detail on these steps as they are pretty straightforward and likely better explained by a realtor or a lawyer. I will comment however on some differences associated with a private sale of land.

Private Sales and Seller Financing

Private sales are typically less formal and more flexible. There is a period of questions and answers between the buyer and seller, warming up to negotiations and an offer. There is room for unorthodox financing methods: I’ve had a potential buyer offer me to trade his truck for land, for example. Seller financing is a flexible option in private sales. When the buyer is willing, they can work with the seller to establish terms of payment on a set schedule. Typically the deed is not transferred until payments are complete. An important discussion point in these agreements is how the land can be used while payments are being made. Can the buyer begin to develop the property? Can trees be cut down? Sellers will be cautious due to liability concerns, so ensure that these points are talked through and jointly understood.

When all factors align, a Nova Scotia real estate lawyer is engaged to draft a sale agreement. This specifies the sale price, deposit amount, terms of payment, and when/how the deed is transferred. As a buyer, you should engage a lawyer to review this document in detail. Most agreements are fairly standard, but you don’t want to regret something later. Below is a fairly basic and standard template of the steps involved in a sale with seller financing. We’ve also added a sample Purchase & Sale Agreement for vacant land in Nova Scotia, with seller financing terms included. It’s important that your agreement includes any loan conditions such as downpayment, interest rates, and payment intervals. You can use an online loan calculator to determine these amounts.

| |

Action |

Owner |

Description

|

|

1.

|

Review confirmation of ownership |

Buyer |

Attached document provided as proof of title ownership

|

| 2. |

Send initial deposit (e-transfer) |

Buyer |

$XXX deposit, refundable if sale agreement is not signed. Once received, owner will pause all advertising and negotiations with other buyers. Receipt provided by Owner.

|

| 3. |

Lawyer engaged to migrate land and create sale agreement |

Owner |

(Name of) law firm engaged to migrate property and draft sales agreement. Legal fees paid by Owner.

|

| 4. |

Review and signing of Sale Agreement |

Buyer |

Sale agreement specifies downpayment, monthly payment terms, conditions of sale.

|

| 5. |

Downpayment sent to Owner |

Buyer |

$XX,XXX delivered to Owner

|

| 6. |

Access to land |

Buyer |

Buyer is granted access to land upon delivery of downpayment, subject to usage terms of sale agreement.

|

| 7. |

Monthly payments |

Buyer |

Monthly e-transfers to owner based on sale agreement schedule. Written confirmation of payments provided by owner.

|

| 8. |

Deed Transfer |

Owner |

Upon completion of final payment, Owner will transfer title of deed to Buyer.

|

Do I need insurance on vacant land?

I’ve been asked by land buyers whether they should hold an insurance policy on their land. The short-but-not-terribly-helpful answer is: it depends. I won’t give a prescriptive answer, just my opinion – and of course you might want to consult with your lawyer. I have multiple lots of vacant land, in remote areas. I don’t lease it out for hunting, I don’t grant permission for access to hikers or snowmobilers, I’m not aware of any open wells or … pit mines… someone might fall into, and I’m not located in shared paths that others might tread. So, no insurance for me at this time. Should someone trespass on my land and injure themselves, I’m fairly confident that I won’t be held liable, so I take that risk. There’s no excuse for negligence however, regardless of the insurance you carry – if there are hazards on your land, take appropriate action to ensure no one gets hurt.

On the other hand, if you have a shared right of way on your property, or agree for any reason to allow others to access your land, it’s worth looking into. Also, if your property has value in the form of standing timber, fire insurance is something to consider.

Is there HST or other tax on land sales?

Most sales of vacant land by individuals are exempt from HST, in Nova Scotia and across Canada. According to the CRA information sheet, examples of exempt sales are:

- the sale of land that had been kept for personal use; or

- the sale to a relative (or to a former spouse or common-law partner) for their personal use of a parcel of land created by subdividing another parcel.

However, there are situations when sales of land by individuals may be taxable. Examples of taxable sales include:

- the sale of land that is capital property that had been used primarily in a business;

- the sale of land in the course of a business; or

- the sale of a parcel of land created by subdividing another parcel into more than two parts.

Based on these definitions, the sale of farm land in Nova Scotia is generally taxable at the HST rate of 15%, but there are some allowable exceptions.

As a buyer, you don’t need to know the specifics of the tax code re: HST applicability. That’s up the to the seller to determine. Just make sure you know whether HST is included, additional to, or not applicable on the sale of the property in question.

If you are out of province, you should definitely be aware of Nova Scotia’s non-resident deed transfer tax, which is 5%. For more on this, view our blog post on the non-resident deed transfer tax. Lastly, for a full round-up of the taxes that may be applicable on a sale/purchase of land, visit our post on Taxes on Land Sales in Nova Scotia.

Owning a portion of Nova Scotia’s natural beauty is something unique and special. I hope you found my tips, advice and information useful, and I hope your search is fruitful in terms of landing you the place of your dreams. Another piece of advice – don’t get lost! Learn about using Nova Scotia GIS maps and you can never be lost again. Then, finally, once you’ve got that land purchased, you’ll be ready to dive into our Nova Scotia Land Development Guide.

I’ll continue to update this document over time, and your feedback can likely make it much better. Please feel free to add a comment below – I will read them all and give them careful consideration.

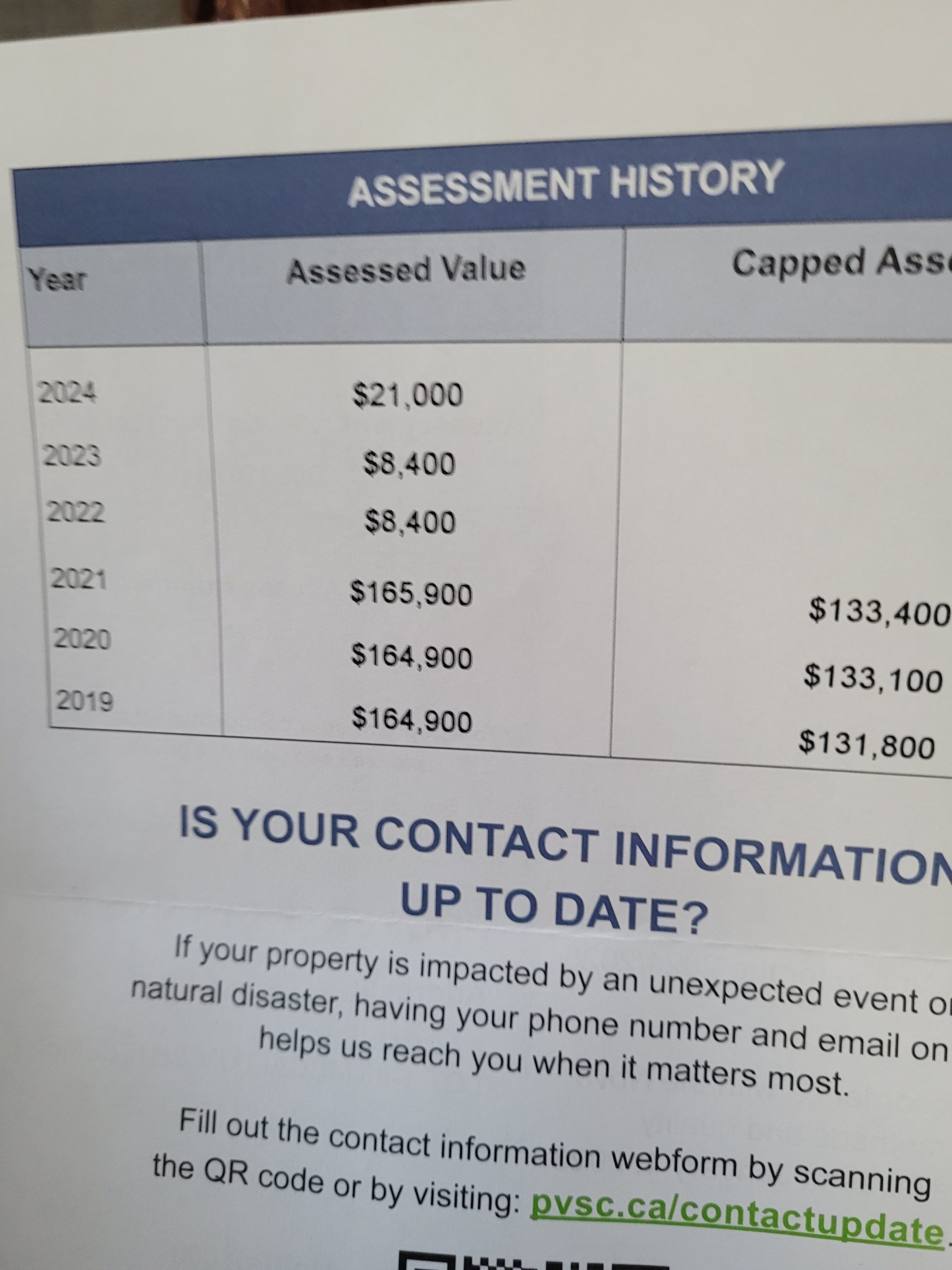

That’s the most important number! That reflects the property value that will determine your Nova Scotia property tax. Unless you have a capped assessment, in which case you’ll pay tax on the lower of the two numbers.

That’s the most important number! That reflects the property value that will determine your Nova Scotia property tax. Unless you have a capped assessment, in which case you’ll pay tax on the lower of the two numbers.