One of the most common questions I hear is “How does the seller financing work?” When it comes to purchasing land in Nova Scotia, particularly in rural or undeveloped areas, buyers may find traditional bank financing challenging to secure. This is where seller financing comes in as a useful alternative. In a seller-financed land deal, the seller essentially becomes the lender, allowing the buyer to pay for the land over time, directly to the seller, rather than securing a loan from a bank.

One of the most common questions I hear is “How does the seller financing work?” When it comes to purchasing land in Nova Scotia, particularly in rural or undeveloped areas, buyers may find traditional bank financing challenging to secure. This is where seller financing comes in as a useful alternative. In a seller-financed land deal, the seller essentially becomes the lender, allowing the buyer to pay for the land over time, directly to the seller, rather than securing a loan from a bank.

How does Seller Financing Work?

Here’s how seller financing (sometimes called owner financing) typically works:

- Agreement on Terms: The buyer and seller negotiate terms such as the interest rate, loan term, and any down payment required. These terms can be more flexible than those offered by traditional lenders.

- Legal Documentation: A Purchase & Sale Agreement is created, outlining the buyer’s obligation to pay the agreed-upon amount, the loan term, the interest rate, and any conditions on their use of the land during the loan term. This document is legally binding, and both parties can involve legal representation to ensure everything is in order. You can find a sample purchase and sale agreement here.

- Title Transfer: Typically the seller will retain the title to the property until the loan is paid off, at which point the deed is transferred to the buyer with the help of a lawyer.

Seller financing can be structured in various ways, depending on the needs of both parties. In my case, I keep it simple:

- I look at the current interest rates for the big banks and set a similar interest rate for the loan

- I share a loan calculator (like this one from Lari.ca or this one from The Globe & Mail) with the potential buyer so they can look at the cost of payments over multiple timeframes (3 years, 5 years, etc.). Once they find a loan duration and a monthly payment amount that suits them, that gets recorded in the purchase and sale agreement

- An initial downpayment is sometimes included

- The agreement includes the ability for the buyer to make additional payments at any time in order to reduce the loan term

- All payments are recorded in a shared online document, which also functions as a receipt for the buyer

Advantages of Seller Financing

Seller financing offers a range of benefits for both buyers and sellers, making it a flexible and appealing option for land transactions in Nova Scotia.

- Easier Qualification Process One of the biggest advantages of seller financing is that it’s often easier to qualify for than traditional bank loans. Buyers who may have difficulty securing financing through a bank—whether due to a lack of credit history, unconventional income, or other reasons—can still purchase land through a seller-financed deal.

- Flexible Terms Seller financing allows for more customized terms than conventional loans. The buyer and seller can negotiate the interest rate, the size of the down payment, the length of the loan, and the repayment schedule. This flexibility can be particularly helpful for buyers who need creative solutions to make the purchase feasible. For example, a buyer and seller may agree on a smaller down payment or a longer repayment period, making the purchase more manageable for the buyer.

- Faster Transaction Because seller financing bypasses the need for bank involvement, the transaction process can be significantly faster. There’s no need to wait for bank approvals or jump through the hoops required by traditional mortgage providers. Once both parties agree on the terms, the deal can close quickly, allowing the buyer to take possession of the land without any delay.

- Potential for Lower Purchase Costs By arranging a financial agreement directly between buyer and seller, the buyer can avoid paying realtor fees, resulting in savings that are typically reflected in the asking price of the land.

How to Structure a Seller Financing Deal for Land

When structuring a seller-financed deal for land in Nova Scotia, there are a few key components to consider.

- Down Payment In some cases, sellers may ask for a down payment as a show of commitment from the buyer. This is negotiated as part of the Purchase and Sale agreement.

- Interest Rates In a seller-financed deal, the interest rate is often negotiable. It may be higher than the rate offered by traditional lenders because the seller is taking on more risk by financing the deal directly. However, with negotiation, buyers and sellers can arrive at a rate that is fair for both parties. Interest rates in seller-financed agreements can vary greatly, and they may be influenced by factors such as the size of the down payment and the length of the loan term.

- Term Lengths and Repayment Plans Seller-financed land deals often have shorter terms than traditional mortgages. Five years is a common choice, but it could certainly be more or less. Most seller financing agreements involve monthly payments of both principal and interest, similar to a traditional loan.

Seller Financing: Risks and Considerations

While seller financing offers flexibility and advantages, it’s important for both buyers and sellers to be aware of the risks involved.

For Buyers:

- Higher Interest Rates: Interest rates in seller-financed deals may be higher than those offered by traditional lenders, making the purchase more expensive over time.

- Default Risk: Most agreements will include wording about how missed payments are handled. That could involve additional interest costs for the buyer. In addition, many agreements will stipulate that if a payment is not received over a specific period (say, 6 months), the agreement is null and void. If you’ve paid off half of the property cost but can no longer make payments, you most definitely won’t own half the land – you’ll have nothing.

- Lack of Traditional Protections: Without the involvement of a bank, some of the safeguards that typically protect buyers in traditional financing arrangements, such as a thorough vetting of the property through an appraisal process, may not be as rigorous.

For Sellers:

- Misuse of Land: While a purchase and sale agreement typically includes provisions for how the buyer can use the land during the loan term, it is difficult to cover every scenario. Actions such as harvesting timber, or dumping waste on your land, can reduce the value of your property.

- Management of Payments: Unlike a bank, the seller is responsible for managing and collecting payments over the course of the loan term.

- Legal Considerations: A poorly structured agreement could leave the seller vulnerable to legal disputes or financial loss. It’s crucial to draft a well-constructed contract.

How to Find Seller Financing Opportunities in Nova Scotia

Seller financing opportunities may not always be advertised, so it’s important to know where to look and how to approach landowners who might be open to this arrangement.

- Working with Real Estate Agents Many real estate agents in Nova Scotia are familiar with seller financing and can help connect buyers with sellers who are open to this option. It’s a good idea to work with an agent who specializes in land transactions, as they will have the most relevant contacts and experience. If you are selling a property via MLS, you can have your realtor include details of seller financing options in the listing. You might need to persist on this point – some realtors very much prefer the ease and speed of the traditional lump-sum cheque that closes the deal.

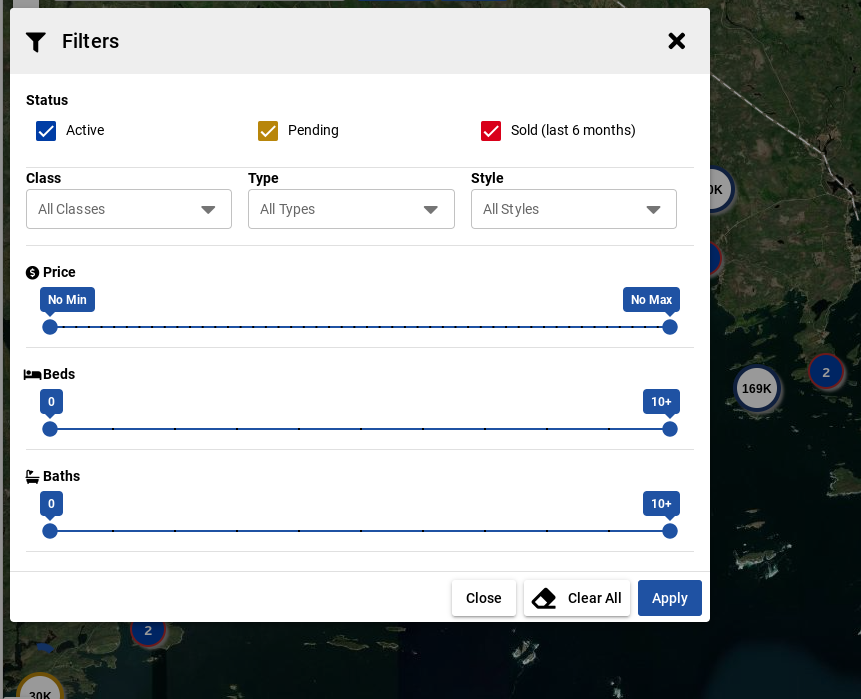

- Online Land Listings and Classifieds Several online platforms specialize in land sales and may offer filtering options to find seller-financed properties. Websites like Kijiji, Facebook groups such as ‘LAND for sale in Nova Scotia’, private land sale websites, or even specialized real estate platforms for rural properties can be helpful.

Additional Costs with Seller Financing

There’s no magic method for avoiding the standard closing costs paid to Nova Scotia real estate lawyers for a real estate transaction. Having the deed transferred and registered involves a cost for both the buyer and seller. In my experience this ranges from $400 to $900 for the seller, and typically costs a bit less for the buyer. Here is what the lawyer provides: Preparation of warranty deed, preparing deed transfer tax affidavit, forwarding Warranty Deed to Land Registry Office, receipt of filed deed from Land Registry Office and delivery of report to client.

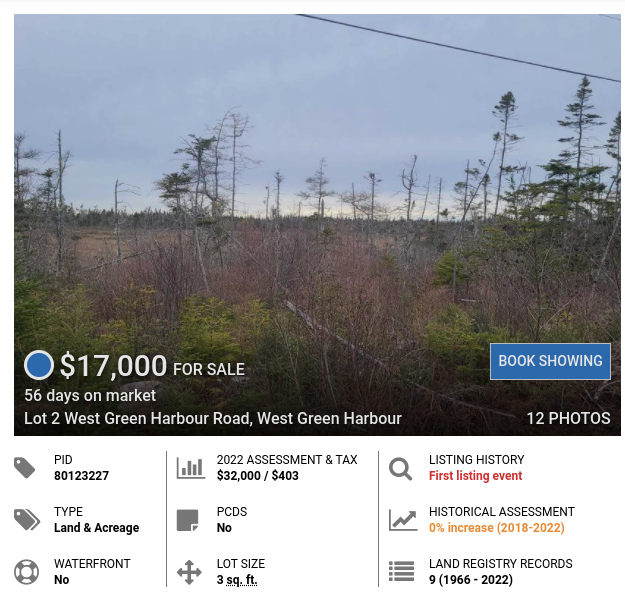

Example of a Seller Financing Deal

In this scenario, a buyer wants to purchase a 50-acre plot of undeveloped land in Cape Breton for $80,000:

- Down Payment: The buyer negotiates a 10% down payment of $8,000 with the seller ($8,000).

- Interest Rate: They agree on an interest rate of 6%.

- Loan Term: The loan is structured over 7 years, with monthly payments of principal and interest. The monthly payment amount is $1,051.82

- Cost of Borrowing: Over the 7-year term, the buyer will pay $16,352.54 in interest. That’s significant, but they will benefit from buying now in two ways: a) they’ve locked in the purchase price and any appreciation over the seven years will add to the value of their investment, and b) they can use the land immediately within the boundaries of their agreement

- Legal Documents: A Purchase and Sale Agreement is drafted and reviewed by lawyers for each party. Once all payments are completed, the deed is transferred to the buyer. The buyer may use the land during the loan term as long as it’s in accordance to the terms of the agreement.

This arrangement allows the buyer to purchase the land without going through traditional financing, while the seller benefits from earning interest on the loan over time.

Seller financing is an excellent option for buyers looking to purchase land in Nova Scotia. It provides flexibility, faster transactions, and an opportunity for buyers who may not qualify for traditional bank loans. However, both parties must carefully structure the deal, be aware of the risks involved, and seek proper legal and tax advice to ensure the transaction is successful and beneficial for both sides.

Dont forget! While seller financing is a useful means for obtaining funding for a land purchase in Nova Scotia, you’ll still want to follow all of the best practices on this site for finding high-value land. That includes topics such as:

- Property migration: how to migrate land in Nova Scotia

- Title search: How to conduct and interpret a Nova Scotia title search

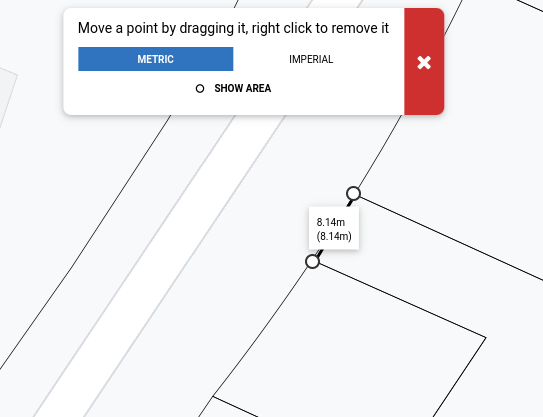

- Surveys: The value of a land survey

- Buyer’s Guide: Our all-purpose guide to buying land in Nova Scotia

- General advice: Good (and bad) questions to ask when buying land

- Taxes: The tax implications of Nova Scotia land sales

- Foreign Buyers: Tips on buying land for foreign residents

- Zoning maps and land use bylaws: We’ve got every Nova Scotia municipality covered