Getting Started with Woodlot Management

A good first step, and a fairly easy one, is simply taking the time to walk your forest and know it well. It’s amazing what you’ll see when you stop and look. A meadow with a lot of new saplings might be new growth replacing an area ravaged by fire years ago, giving new species an opportunity to change the forest composition. You’ll see mature trees dominate light in some areas, leaving room only for their seeds to grow. You’ll notice how one stand of trees changes abruptly to another, and with some practice you can likely spot the landscape factors causing the transition such as shade or soil composition.

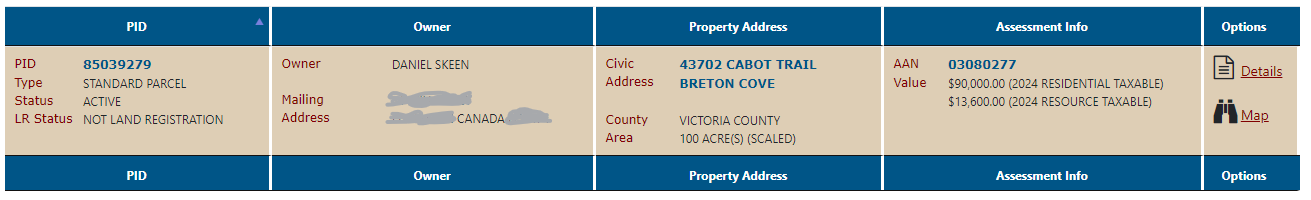

That’s all good, but when you’re ready to get into harvesting practices and regeneration, you may want to call in a professional. I own a 100-acre lot in Cape Breton that is primarily forest, so my approach has been to work with a forester to create a forest management plan for that property, and learn as much as I can so that I can apply some of the practices to smaller parcels of land that I own.

Joining a Woodlot Owners Association

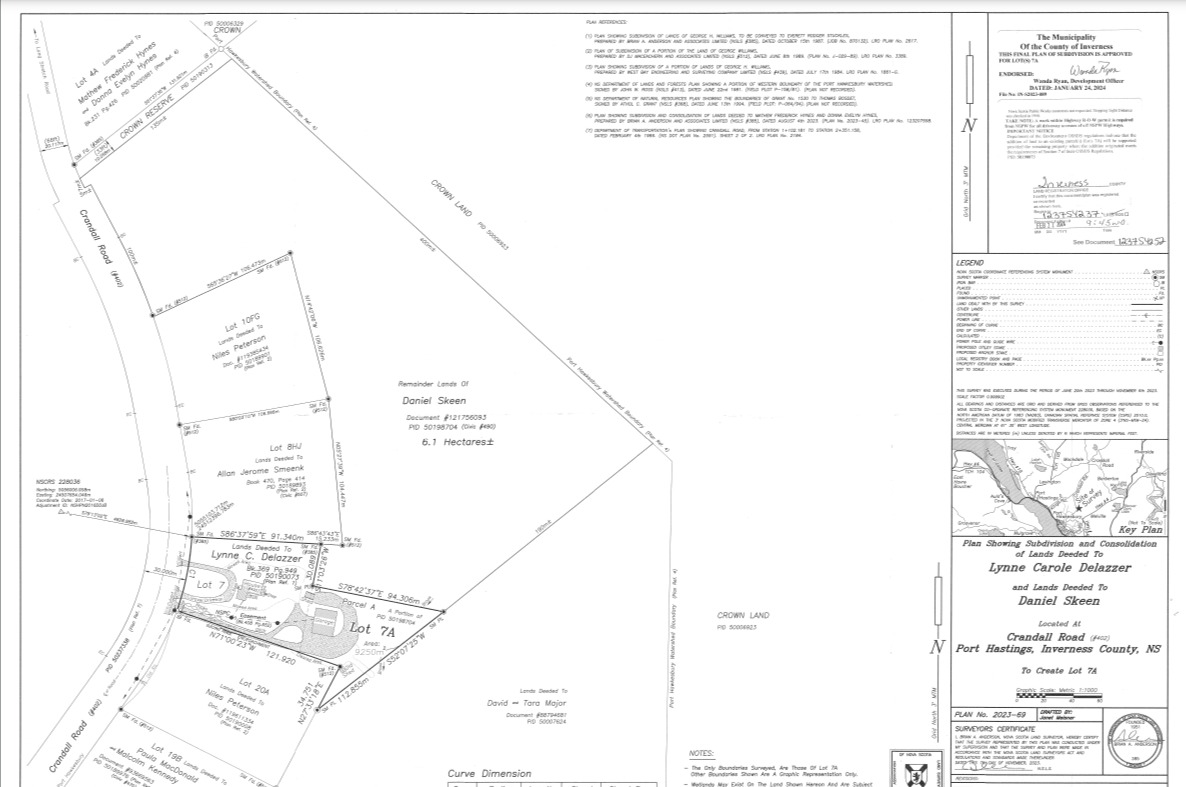

As a woodlot owner, it can really help if you can leverage the expertise of others to manage your forest. That’s where a Woodlot Association can help. For my property in Cape Breton, I joined the Cape Breton Privateland Partnership (CBPP). For a small annual fee, this association will prepare detailed maps on your woodlot showing species, age, wildlife considerations, and much more. The maps are free, and as a next step you can obtain a forest management plan prepared by a forester for a highly discounted rate. I’ll dive into that later.

If you’re looking for an association, or just some valuable information to help you manage your woodlot, see the section on resources for woodlot owners in Nova Scotia below.

Getting a Woodlot Assessment Report

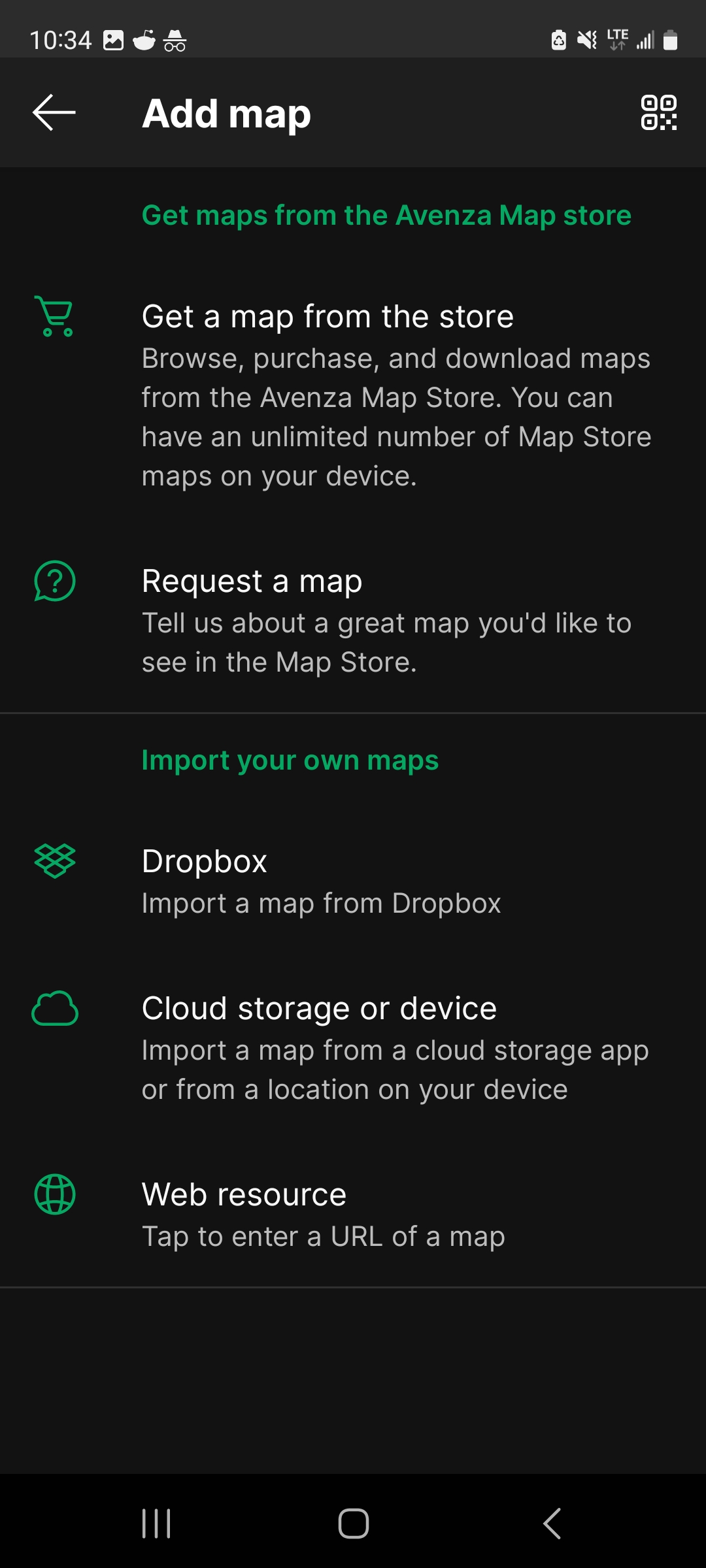

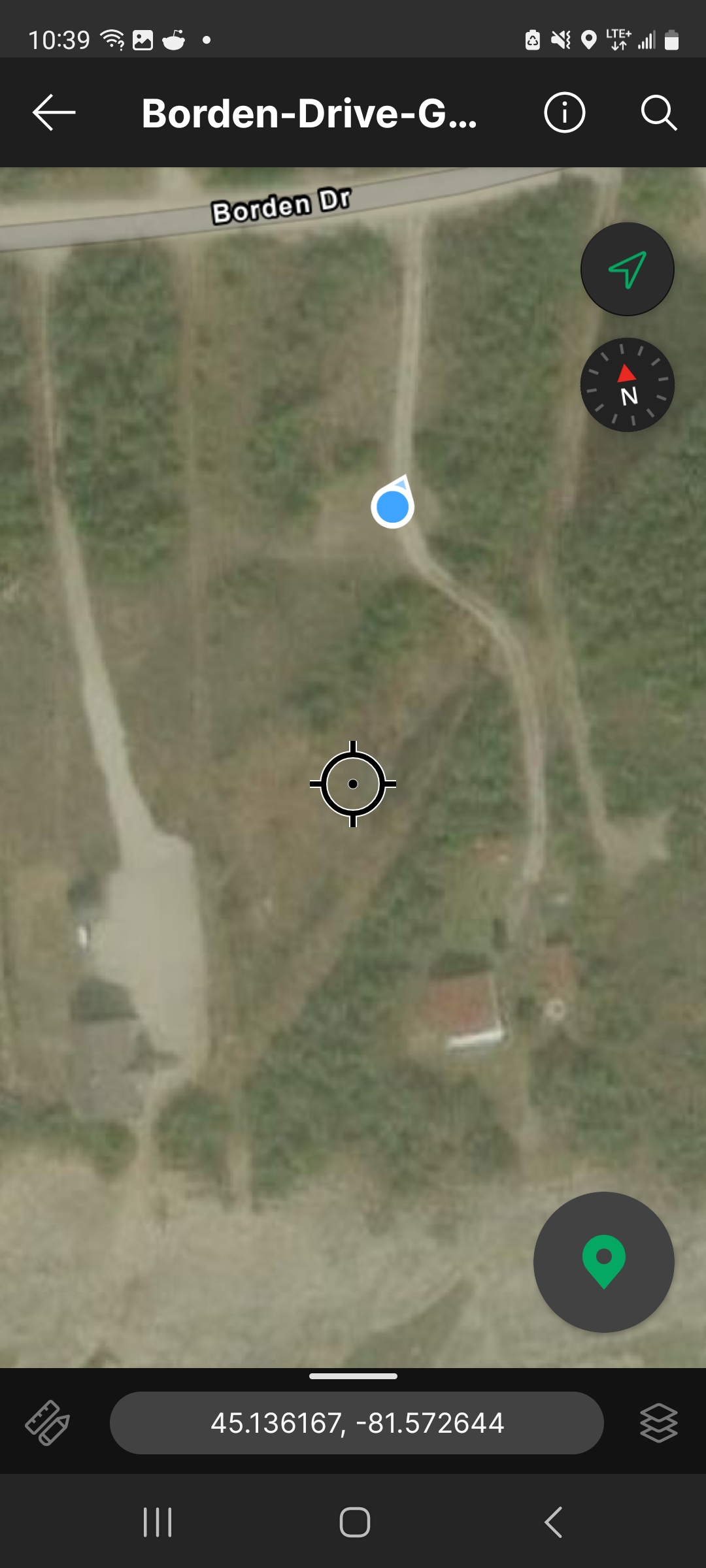

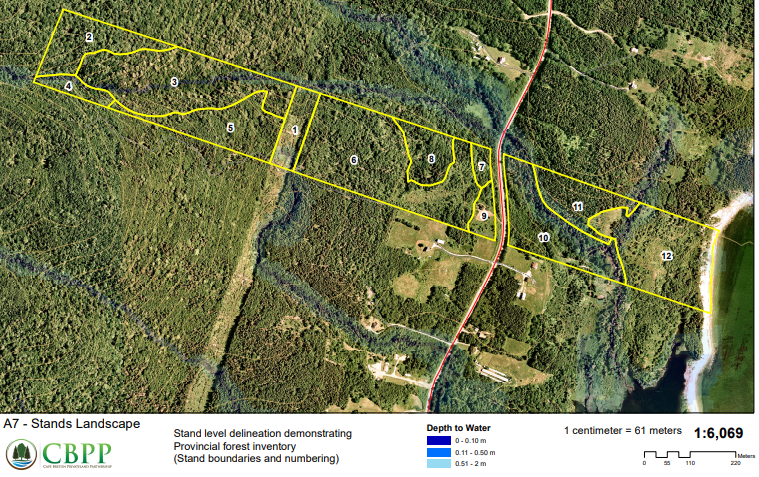

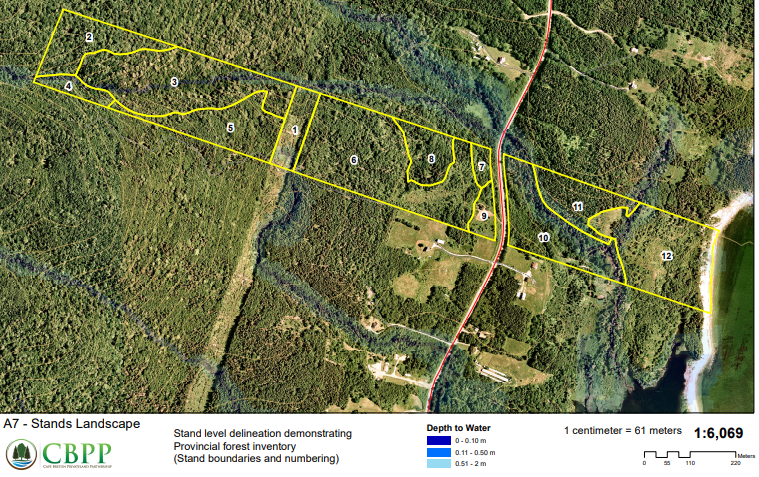

Through my woodlot owners association, I can receive woodlot maps and reports, for free! Now, they tend to only offer this service for lots of 10 acres or more. I truly value these reports – for one thing, it will give you extremely high-quality satellite imagery of your property (from GIS mapping tools) with the property boundaries clearly shown. Furthermore, the files are delivered as geo-linked PDF files. Without getting too tech-y, the benefit of this is you can load these files into a free map reading application like Avenza maps, and when you walk the lot you will know your precise location, even when cellular service isn’t available. This has been a game-changer for a guy who has often found himself wandering large lots not entirely sure if I’ve stumbled into the neighbouring lot of a drunken hunter. (Note: I’ve just written a much more detailed guide to creating and using Nova Scotia GIS maps, including property boundaries as defined by the Nova Scotia Property Online registry.

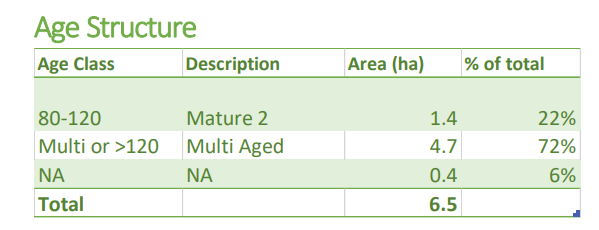

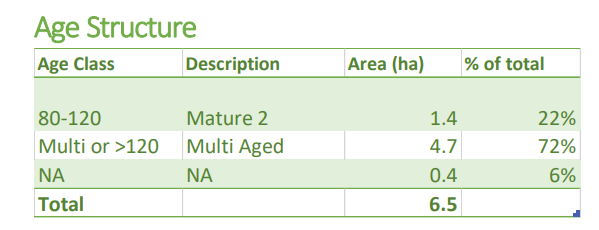

But back to forestry. The woodlot assessment report contains some great information, gathered from forestry databases (not the first-hand observation of a forester – that is covered in a section below). You’ll find tables like this… showing the composition of your forest by age and area.

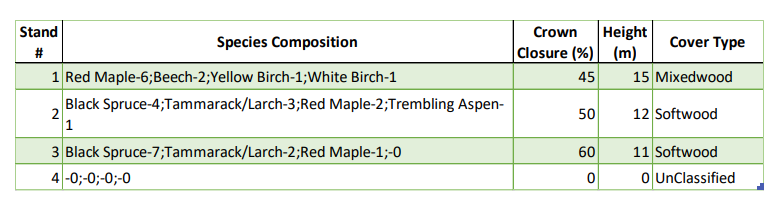

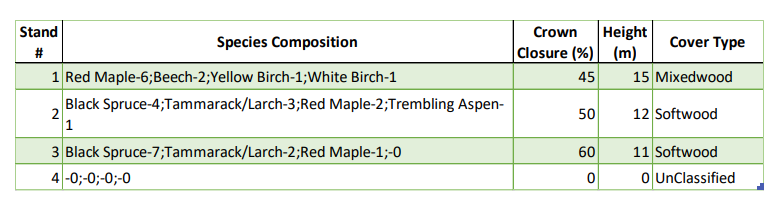

Basic stand information lets you know the specific species observed on your woodlot.

There is a section for sensitive areas (e.g. water supply zones) and wildlife habitat.

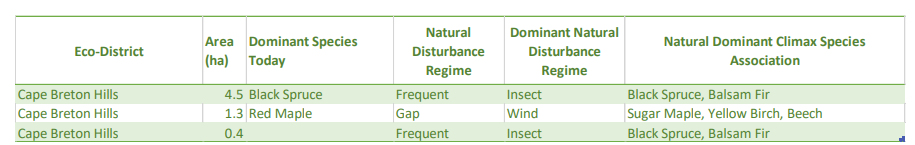

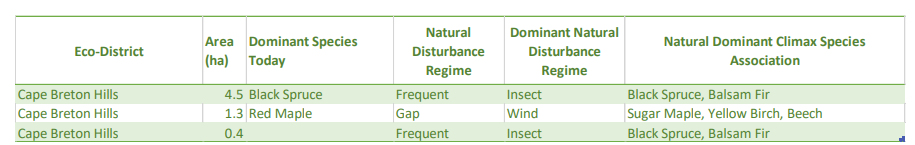

Based on Acadian Forest characteristics, you can explore the most dominant natural disturbance for an area, such as wind, fire, or insects.

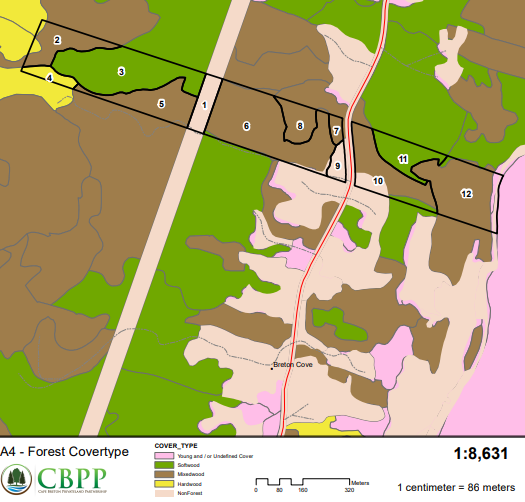

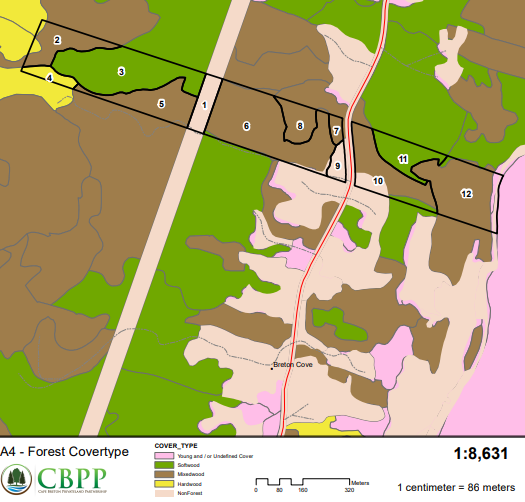

The maps really are the best part of the report though. Here’s an example of a map showing forest cover type:

And here’s the same view using satellite imagery:

Creating a Woodlot Management Plan

Once you’ve received a woodlot assessment report, you may want to take the next step, which is engaging a forester to create a forest management plan. Through my woodlot association, I received a discounted price of $500 for creating a plan ($1,200 for non-members). With this service, a forester will walk the lot and provide more detailed documentation on your woodlot, as well as recommendations for sustainable harvesting in the years to come. As you can see from the image above, I own a long and incredibly steep 100-acre lot. Just walking it end-to-end is a workout. I can verify that the forester I hired trudged through the whole thing – he knew all areas of the land very well, with specific details.

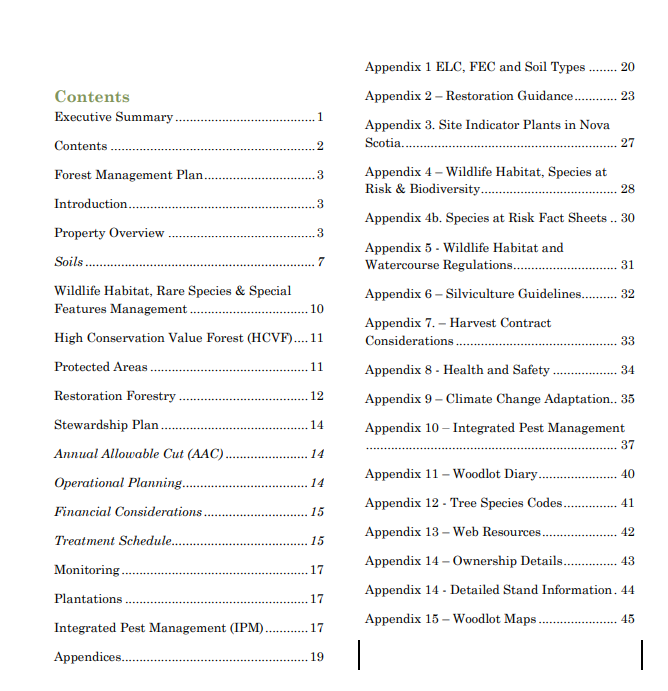

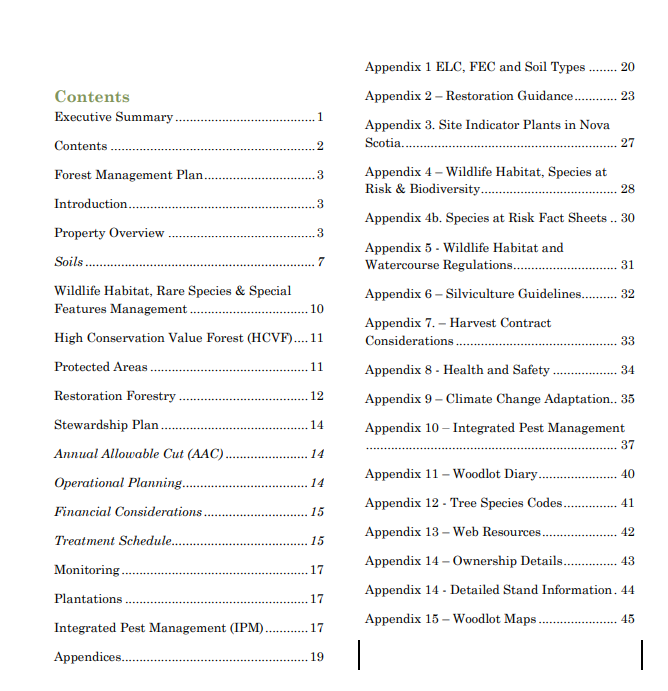

The Forest Management Plan included over 45 pages of details on my woodlot – way too much to summarize here. For a sense of what’s included, here is the table of contents:

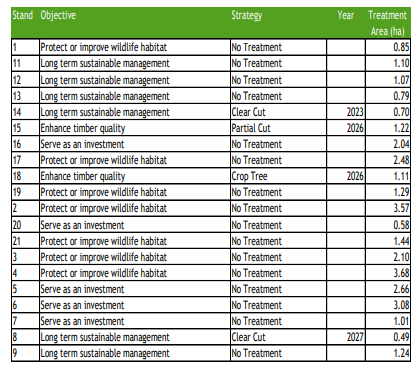

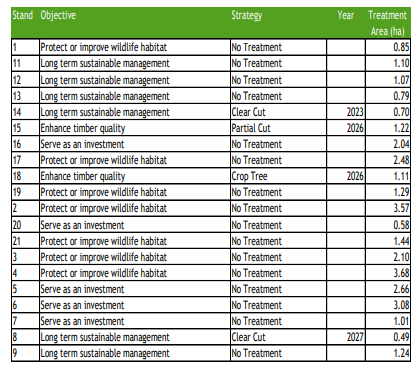

Let’s get to what I learned from the report. The most valuable section for me was the recommendations. In most cases, the answer is ‘leave it alone and let it grow’. In some zones, there were recommendations for a clear cut, a partial cut, or crop tree harvesting. I have opted to hold off until around 2026 so I can have work done on multiple forest sections at the same time. What’s that worth? It’s in the thousands, but not the 10s of thousands.

The report also contained some useful information on soil types, threats to the tree species on my lot, and the annual allowable cut (the maximum amount of wood that can be cut off my woodlot in a year).

The forester walked me through the report in detail, and answered every single question I had. He also informed me about silviculture grants that may be applicable for reforesting after any harvesting is done. All in all, well worth the money spent.

Working with a Forester for Harvesting

As mentioned, I haven’t yet harvested a single tree from my lots, so I’m no expert. But I do have a handy fact sheet from NSWOOA about hiring a contractor. Here are the things they recommend including in a contract:

- Term: how long the contract is valid for

- Estimated start date and end-date of operations

- Property identification: The PIDs for the land

- Method of Payment: Who is paying whom? This section should also include any estimates or quotes and commitment to meeting budget. If you are receiving payment for your forest products, it should be clear whether it’s lump-sum or a fixed rate based on mill scale.

- Proof of liability insurance: including Worker’s Compensation and liability insurance

- Compliance with regulations: The contractor should agree in writing to comply with applicable laws

- Signatures: including witnesses

- Maps: Showing a clearly defined area of operations as well as loading spots, proposed roads, etc.

- Prescription: It should be very clear what activity is occurring in each forest area, such as clear-cut, selection management, or tree planting.

- Extent of responsibility: The contract should specify all areas of accountability for the contractor, including harvest, hauling, selling, or post-treatment assessments.

- Safety Plans: should address any special considerations in treatment areas such as a steep slope, or fire prevention.

- Post-harvest assessments: After harvest, the site should be inspected to ensure best practices have been followed, and a 2-year inspection post-harvest is also recommended to determine how the forest is responding.

Carbon Offset Programs for Nova Scotia Woodlot Owners

There has been a lot of promise, pilot programs, and scandal surrounding carbon credits. The premise is, woodlot owners opt to let trees grow instead of clear-cutting. This prevents the release of carbon into the environment and helps with global warming as forests are very effective at sequestering carbon. In return, woodlot owners receive carbon credits which have a free-market price (like a stock) that can then be sold.

I follow news in this area closely, and have yet to see a viable option/program for woodlot owners in Nova Scotia. However, this space is changing rapidly so time may change things. If you know of a carbon-credit-based program that Nova Scotia woodlot owners can apply for, please let me know!

Resources for Woodlot Owners in Nova Scotia

Family Forest Network: 11 organizations have networked to provide support to woodland owners. You can find some valuable resources on this site.

Nova Scotia Woodlot Owners and Operators Association (NSWOOA): This association offers resources and a mentorship program for woodlot owners in Nova Scotia.

Nova Scotia Department of Natural Resources and Renewables: Offers a free home-study program to learn the basics of woodlot management.

NSWoods.ca: Find events and conferences for woodlot owners in Nova Scotia

A Final Thought for Nova Scotia Woodlot Owners

One of the most beautiful elements of Nova Scotia are the boundless trees that we see everywhere. It’s easy to take these gentle giants for granted. And of course, people need money to pay bills, and for many, fuel to heat their homes. I’m not advocating a total hands-off approach to forestry – in fact, forests can become healthier through human involvement. It’s simply a matter of taking an informed approach, giving thought to the health of the forest, and what we’ll leave behind for the generations that follow.

One of the most common questions I hear is “How does the seller financing work?” When it comes to purchasing land in Nova Scotia, particularly in rural or undeveloped areas, buyers may find traditional bank financing challenging to secure. This is where

One of the most common questions I hear is “How does the seller financing work?” When it comes to purchasing land in Nova Scotia, particularly in rural or undeveloped areas, buyers may find traditional bank financing challenging to secure. This is where